where to find betterment tax documents

The bottom line is that they are delaying your tax refund because they dont want to lose more money. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

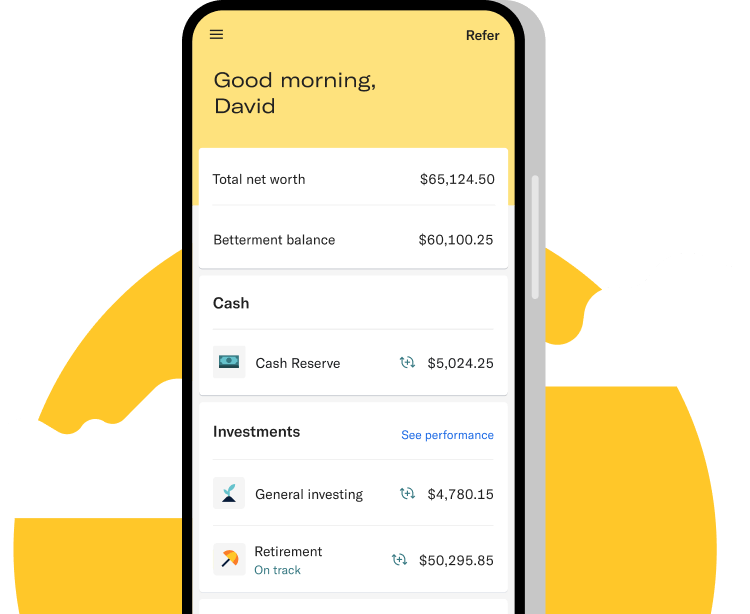

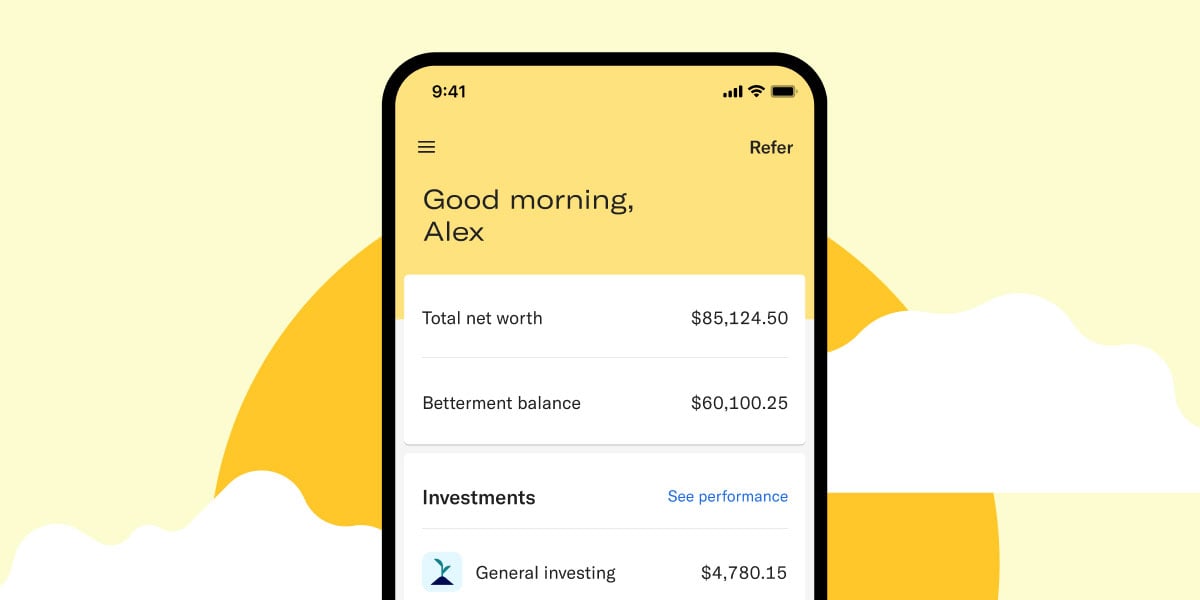

Betterment Mobile App Investing On The Go

Clark says as long as you own and collect rent on any property you should keep all the related records.

. How Tax Bills are Calculated. Tax Payments Online. It can be easy to misplace important documents like 401k details from a previous employer.

It is a document that shows a property owner having an account with the Municipality or any civic authority BBMP-Bruhat Bangalore Mahanagara Palike for paying taxesThe details of a it include the property owners name sizemeasurement of property locationbuilt-up area vacant or occupied etc and is. Notice of names of persons appearing to be owners of funds held by the Town of Grafton and deemed. These seven members are charged with making sure that the school district operates in the best interests of the students and the community.

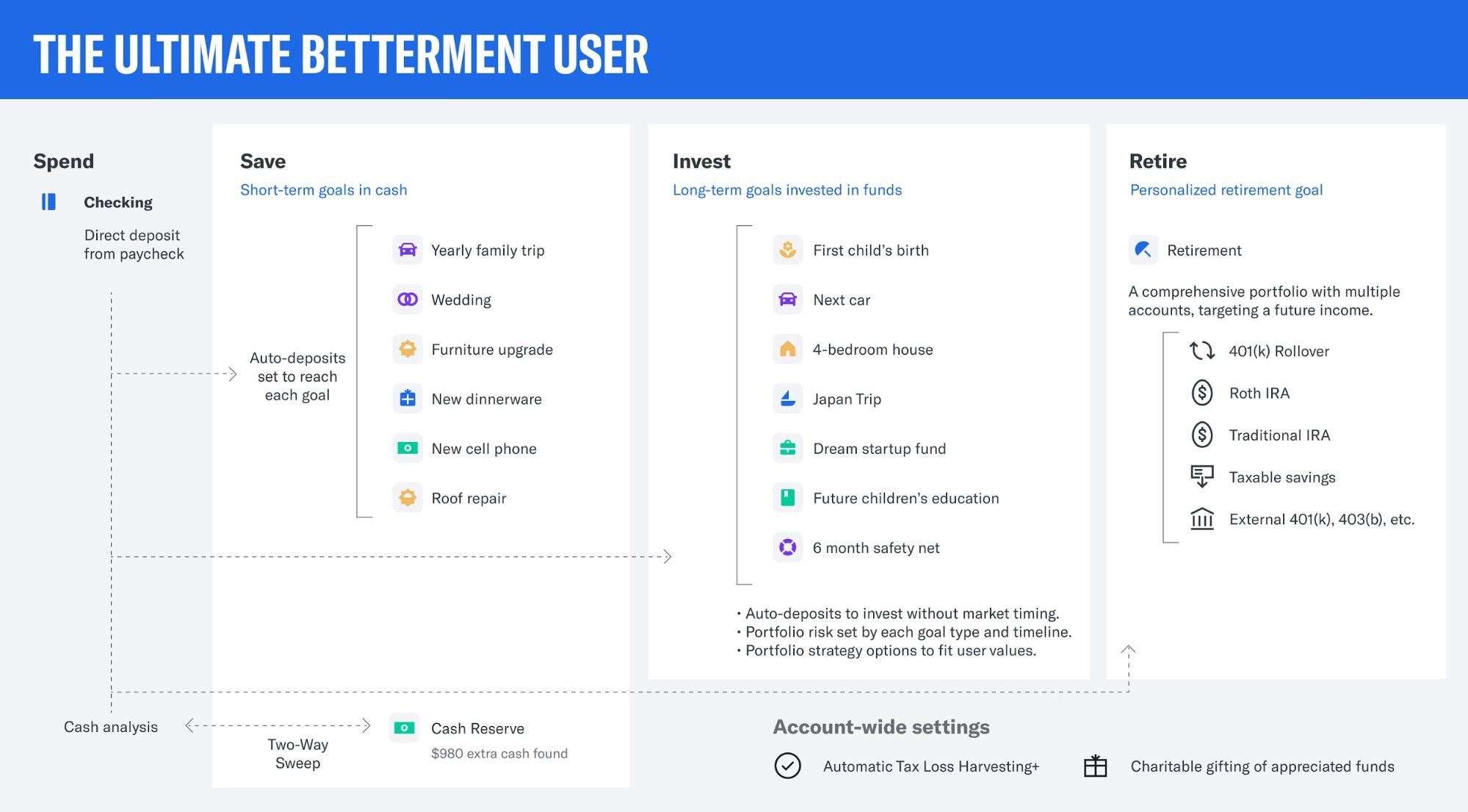

Betterment has multiple pricing plans from fee-free plans to 04 annual fees. All members serve without pay. The Town Clerk is responsible for the registration recording and management of all vital events and records occurring in the Town of Gilford.

However the following are the most common working remotely tax implications to know about. From FY 2017-18 the Tax benefit on loan repayment of second house is restricted to Rs 2 lakh per annum only even if you have multiple houses the limit is still going to be Rs 2 Lakh only and the. About the Board of Education Kansas City Kansas Public Schools is governed by a seven-member body of citizens elected by the voters of the school district.

So if a criminal files a tax return in your name before you do and they steal your refund - they win the race. Going through a detailed checklist makes sure everything is in order for the actual closing. The no-fee plan costs 0 in fees and requires 0 in a minimum balance.

Think of it as a dress rehearsal before the big show. FAQs Important Information For Taxpayers. The documents include- Title Deed property assessment extract property PID number city survey sketch from the Department of Survey and Settlement and Land Records up-to-date tax paid receipt earlier sanctioned plans if any property drawings 2 copies of demand drafts foundation certificate if any and a land use certificate issued.

But if you start working remotely full-time across state lines you may have to file and pay tax in two states. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Yet these funds are vital to retirement planning and calculating your net worth.

For the government they will end up paying you the proper refund but they also lost the money that went to the criminals. 1 online tax filing solution for self-employed. Or perhaps youre the surviving spouse or child trying to track down an estate benefit.

Betterment charges etc. A dual function office of Town Clerk and Tax Collector serving the needs of all residents and taxpayers of the Town of Gilford in accordance with the laws of the State of New Hampshire. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Gather any documents you have handy and collect the others prior to filling out the loan application to help avoid delays and facilitate a. For rental properties the documentation you have from the income you receive from that property but more importantly the expenses you keep for as long as you own the property because you never know how thats going to play out Clark says. Municipal Lien Certificate Request Form.

Mission Statement and Office Responsibilities. Checklist of Important Property documents. The grantor will continue to report all of the income and expenses of the trust on his or her individual tax return.

Khatha literally means account. Checklist for Property purchase in India. Your pre-closing checklists should include a number of things that must be sorted from the terms of the loan to the appraisal and various documents that will lead to a successful closing.

Tax rates in Mississippi are determined by local tax authorities based on the amount of revenue they need to fill their budgets. Americas 1 tax preparation provider. What is Khatha.

Page ContentWhile most employers make sure they comply with the Employee Retirement Income Security Acts plan documentation and disclosure requirements with respect to their retirement plans. Mississippi Property Tax Rates. Form for unclaimed property.

Tax rates are expressed in millage rates. Betterment Release Request Form. This account includes a checking account a.

One mill is equal to 1 of tax for every 1000 in assessed value. Once the grantor dies and the trust becomes irrevocable you will need to complete the application for an EIN as soon as possible so you can properly report all post-death transactions under the trust EIN. If you work in the same state as your employer your income tax situation probably wont change.

Here are the steps you can follow to find an old 401k. No matter the investment platform if you recognize gains receive dividends or earn investment income from investments youll still need to pay your share of taxes. Learn more about the tax treatment you may face with modern investment tools such as Acorns Betterment Robinhood Stash and more and whether or not these tools support tax-efficient investing.

Betterment Sophisticated Online Financial Advice And Investment Management Investing Financial Advice Finance

Betterment Review 2021 Is It Really A Smarter Way To Invest

Betterment Checking And Betterment Cash Reserve Review Cash Management Certificate Of Deposit Best Ira Accounts

Services Provided By A Title Company Title Insurance Title Property Tax

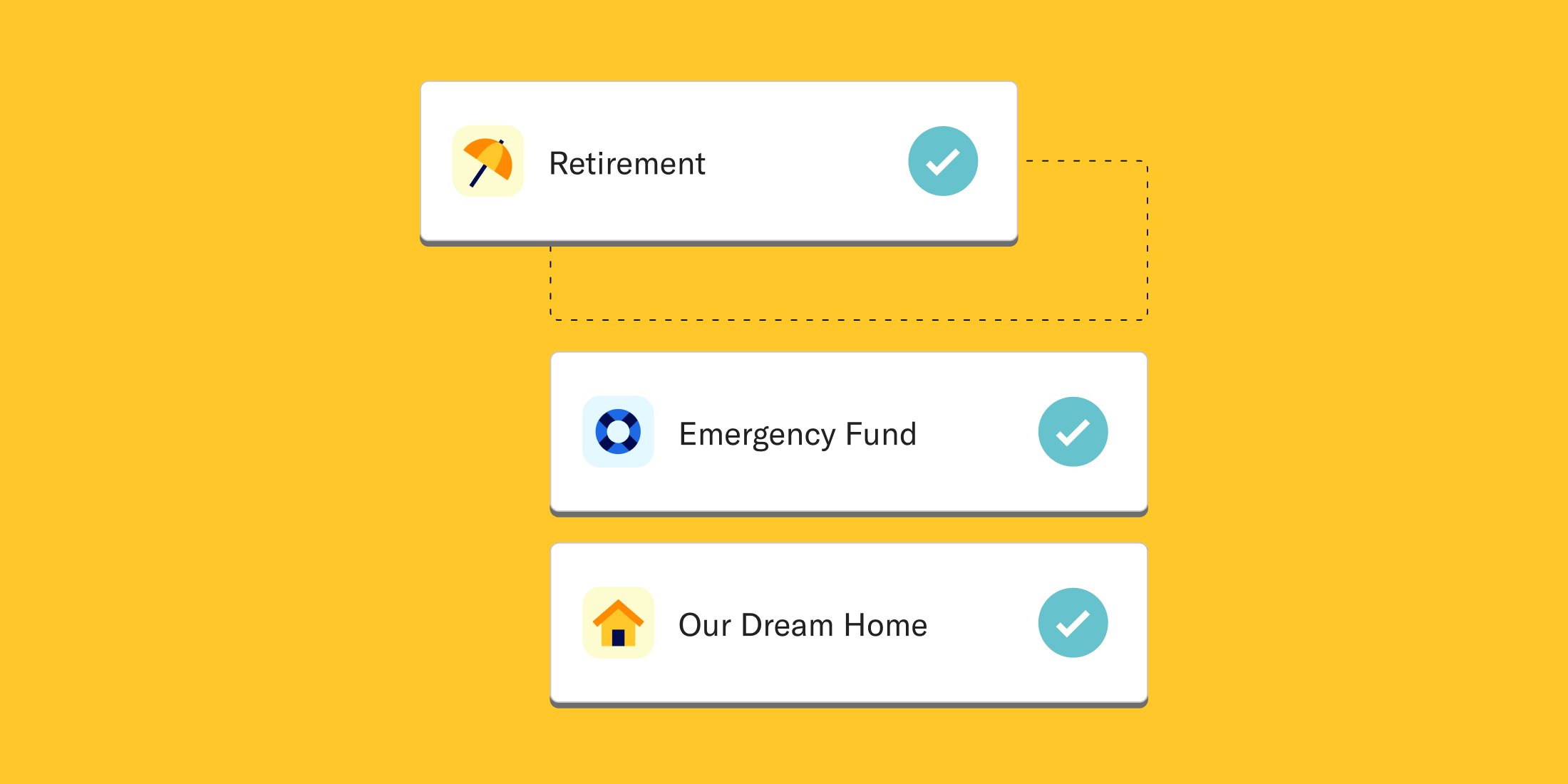

Betterment Safety Net Review A Better Place For Your Emergency Fund Millennial Money With Katie

6 Tax Strategies That Will Have You Planning Ahead

Betterment Retirement Income Retirement Retirement Advice

Everything We Learned About Investing Was Wrong That S Why We Need Betterment Frugaling

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Season Calendar Tax Season Tax

Do You Know Did You Know Real Estate Investing How To Plan

Tax Smart Investing With Betterment

What The Ultimate Betterment User Looks Like

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

How To Start Investing With Betterment Investing Start Investing Robo Advisors

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

Tax Smart Investing With Betterment

Using Investment Goals At Betterment